Copyright Info: Entire Document sourced from Oracle Help

Oracle E-Business Tax

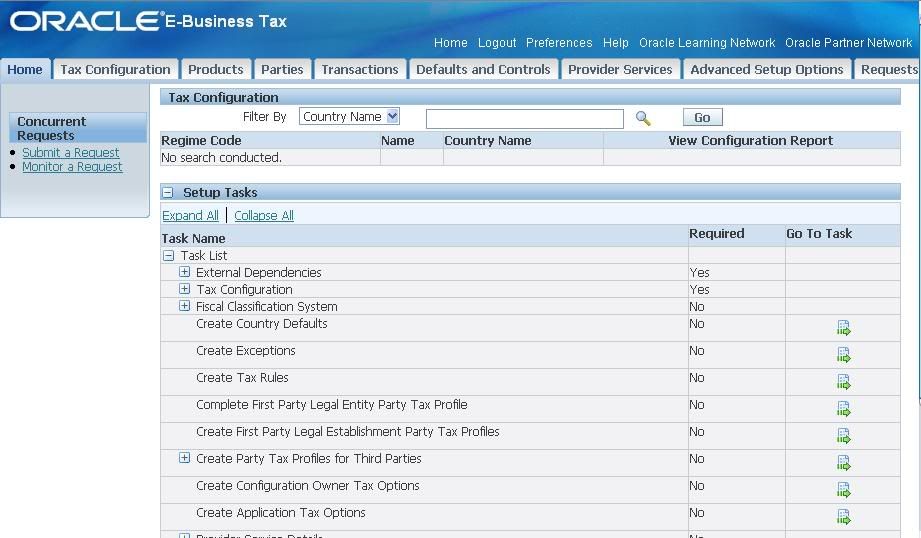

[caption id="" align="alignnone" width="829" caption="E-Business Tax Homepage"]

[/caption]

[/caption]E-Business Tax allows transaction tax requirements in all geographic locations where the company has business. Configure your taxes to include rules, default values etc. for each tax requirement. At transaction time E-Business Tax uses tax configuration to determine which tax applies. Based on this the tax amounts are calculated.

Tasks involved in setting up tax requirement fall in the following categories:

- Setting up transaction taxes. Evaluate your tax configuration first.

- Completing all of the setups and settings related to the processing of taxes on transactions.

- Setting up tax rules and defaults to manage tax processing.

E-Business Tax and Transaction Taxes

E-Business Tax provides tax services for Order to Cash and Procure to Pay business flows in these applications:

- Advanced Global Intercompany System

- Consigned Inventory

- Oracle General Ledger

- Oracle Internet Expenses

- Oracle iProcurement

- Oracle iStore

- Oracle Order Capture

- Oracle Order Management

- Oracle Payables

- Oracle Projects

- Oracle Purchasing

- Oracle Receivables

- Oracle Services Contracts

- Oracle Trade Management

E-Business Tax does not provide tax services for these transactions:

- Payables withholding taxes.

- Latin American Receivables transactions.

- India transaction taxes.

You can continue to set up and maintain these taxes in the Oracle E-Business Suite using the functionality available from Release 11i.

Oracle Help

30 June 2009

No comments:

Post a Comment